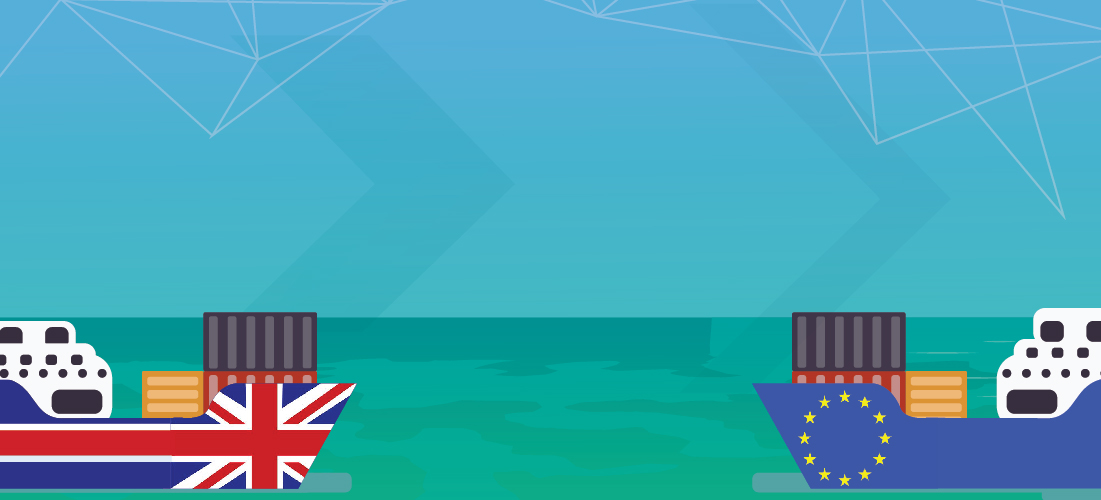

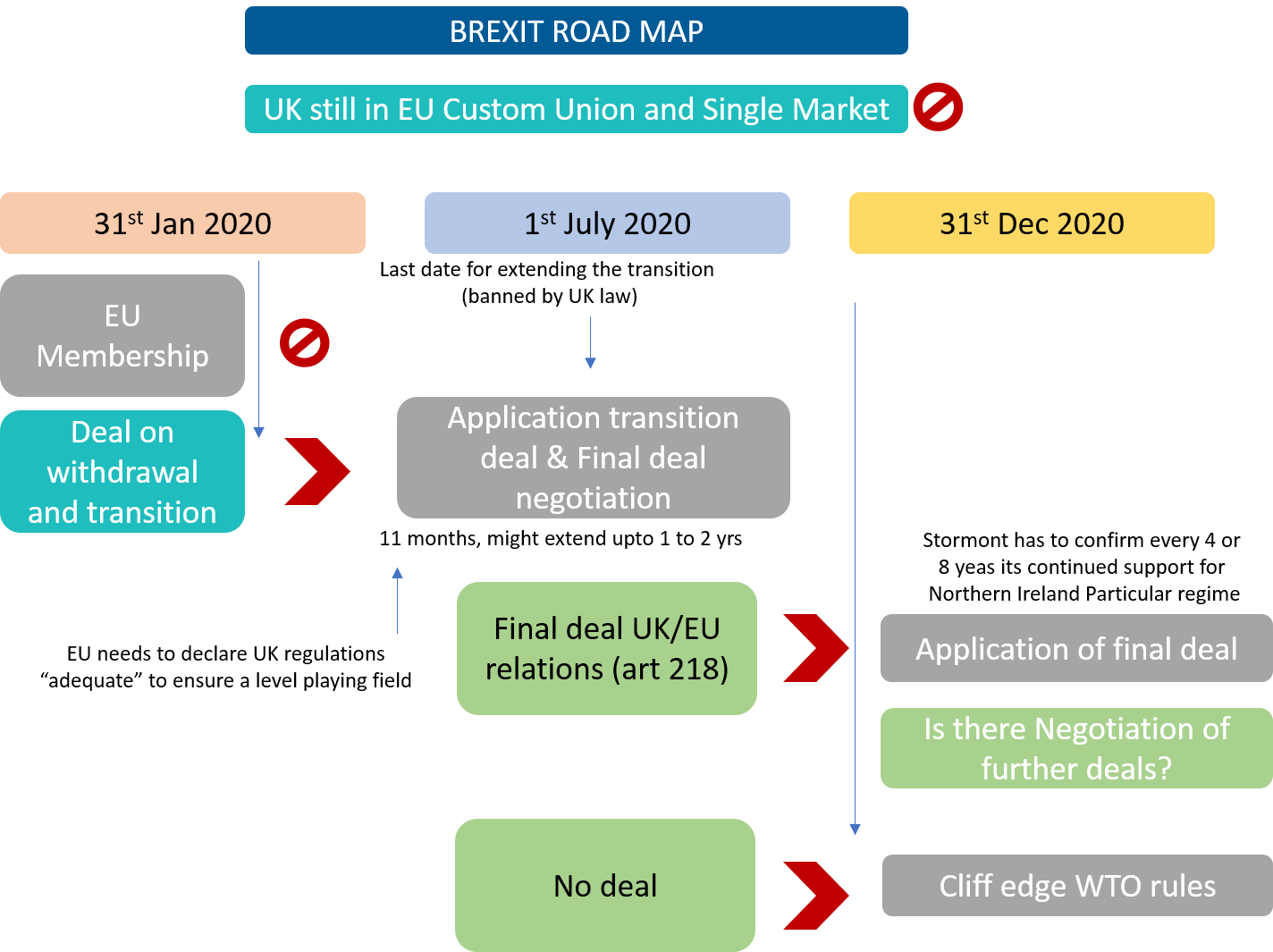

Brexit, the most important constitutional radical restructure for UK. The road map has outlined the impact of the Brexit implementation.

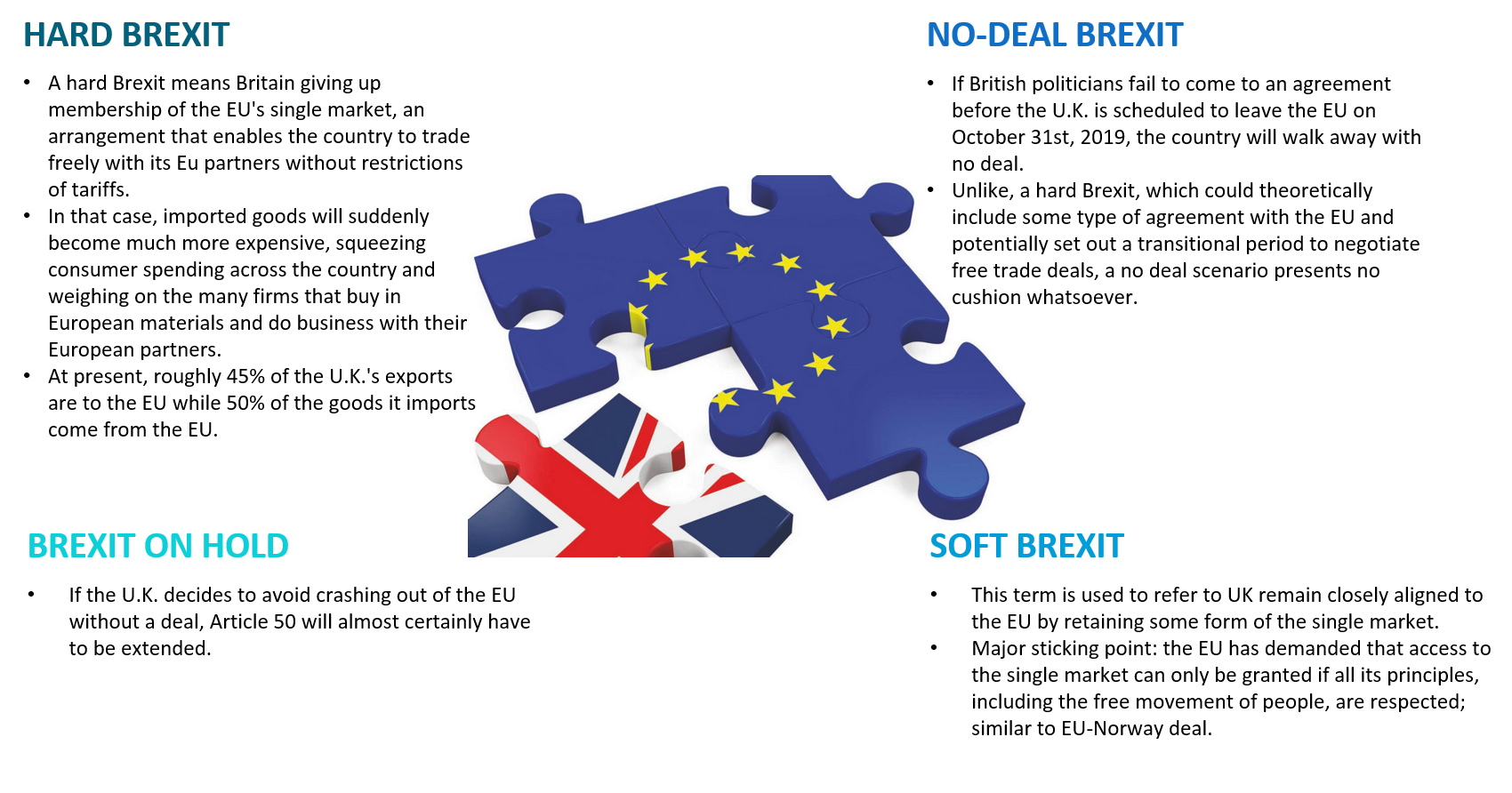

Here is a breakdown of different terminologies of Brexit doing the rounds and how each of them can impact the investors and economy.

The UK leaving the EU is not an uncertainty anymore. From 31st Jan. 2020, the impact of it will be felt in the businesses around the world. Brexit is a reality that businesses around the world have to face and prepare for. Whether you are: Exporting to UK – direct or indirectly, doing multinational trade via the UK, into the UK – directly or indirectly or manufacturing and configuring for exports in the UK. In all the cases, Brexit will affect your business operations – in terms of costs and timelines. But it can be an opportunity and threat, depending on how a business is prepared to handle it.

Some of the key implications for businesses operating in the logistics sector:

No-deal or hard disruptive U.K. exit from the EU will have catastrophic implications for Europe’s trucking companies and supply chains.

Air Freight

UK carriers will not be able to fly between two third countries and stop in the EU, nor will they be able to fly between two member states or within the one-member state which could impact certain freight routes.

Maritime Landscape

Shipping can be broadly thought of in terms of Short-sea routes and the Deep-sea routes at inland EU ports as well as international freight traffic. No deal will affect them with Cabotage (transport between port to port which will not be liberal)

Road Haulage

Road haulage is the dominant mode of freight transport within the UK. The majority of goods imported to and exported from the UK by road are handled by overseas haulers. No deal will affect them with international driving permits they need to issue for driving through the EU and EEA countries.

Rail Sector

There would not be any foreseen that Brexit will affect the UK’s relationship with non-EU countries pertaining to the rail sector. The UK is currently a member of international rail organizations and is likely to remain so.

Borders

The UK government estimates that there will be a 6 month period of disruption at the UK border, being at its worst for the first 3 months. Delays could arise due to a number of factors:

- Additional safety and security checks required at the border and limited space to undertake these

- Drivers not having the necessary licenses and permits

- Inexperienced traders not having the necessary paperwork when arriving at the border

LSP Contracts

Few LSPs have written clauses into their contracts that ensure delivery within a certain timeframe, with penalty clauses being activated for delays to delivery. Managing these obligations in a no-deal scenario will be important as it may need updating to manage some of the potential risks arising from Brexit or in response to Brexit-related restructuring.

Taxation

The ramifications of any Brexit depend upon its form majorly will be VAT; which will rise around a fifth of the UK’s tax revenue. Exports of goods and services outside the EU are generally excluded from VAT, however, EU Member States do generally charge VAT on the import of goods and services from outside the EU which will be an applicable scenario to UK post-Brexit.

Customs

Consignees of goods shipped across a customs border may need to make payment of duty. In a no-deal scenario, the value and volume of such payments will increase significantly. This could present challenges for LSPs – such as communicating to parcel recipients why/what duty is payable, ensuring robust systems and processes are in place to handle increased payments.

Across the Globe & UK

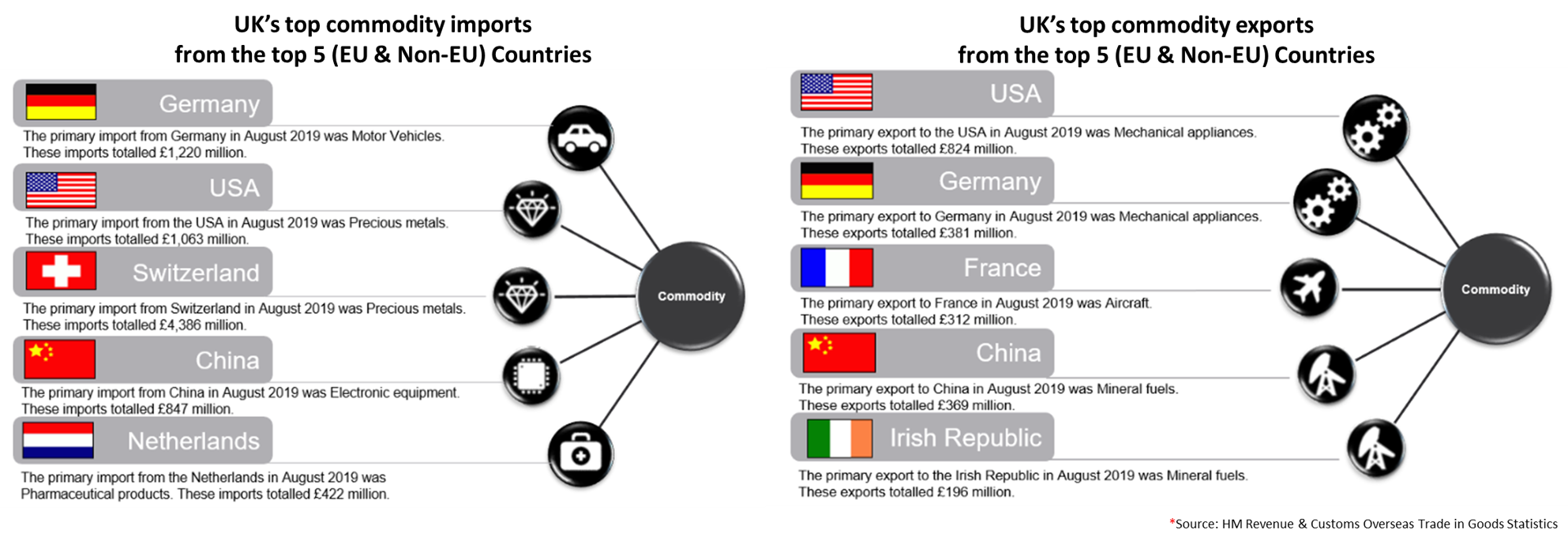

Post No-deal Brexit, the actual commercial impact for importers across the globe will be TARIFFS. U.K. comes out of the EU; tariffs will be based on World Trade Organization terms. Other companies/retailers across the globe that trade and ship product from the U.K. will get hit with a second tariff. That will essentially be a double blow.

Other issues like airline licenses, medicine certifications, and certain civil rights might end overnight with an increase in bureaucratic checks on goods and people traveling to and fro from the country.

The UK needs to keep a fast pace post-Brexit and set-up bilateral free trade agreements to keep its economy going especially in US & China. If that doesn’t work out, 80% of giant Manufacturers & Retailers having distribution hubs in the UK; might shift to EU territories specifically to Benelux (Belgium, Netherlands, and Luxembourg).

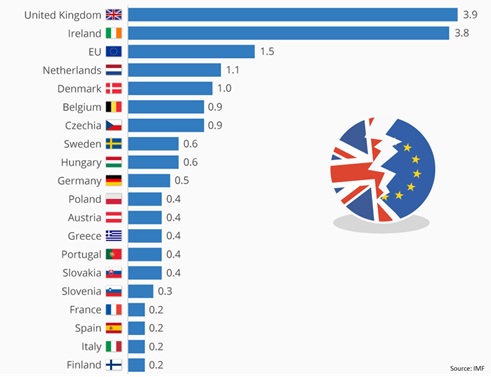

According to estimates from the International Monetary Fund (IMF), a hard Brexit would also lead to significant long-term economic damage across the European continent. Below is Estimated GDP losses % in case of No-deal Brexit scenario:

The Guardian reports that the UK will face a three-month meltdown at its ports, and a ‘hard’ Irish border, according to government documents on Operation Yellowhammer. The dossier says up to 85% of lorries using the main channel crossings “may not be ready” for French customs and could face queues of two and a half days.

Key Challenges that Logistics Companies Could Face as a Result of Brexit:

LSPs & other supply chain companies can find ways to balance the BREXIT impact:

Faster Digitisation:

It’s time to implement internal, external and inter-company digitization and standardization of processes to bring in transparency, documentation handling, and price discovery.

Market Platforms:

Multimodal capability to handle forwarding platforms will be a norm in the future. This provides an opportunity to optimize costs and find models to benefit from the opportunities created by Brexit.

How DiLX Can Help?

DiLX has been supporting multiple businesses across a T&L Ecosystem to understand the implications of, and prepare for, the UK’s withdrawal from the EU. We have core knowledge & expertise base about post Brexit consequences & checklist planning. Our teams with Brexit insights, industry knowledge and technical expertise to support our clients with their Brexit readiness checklist planning – from risk factor management to optimize for the future trading environment.